Medicare Planning

SKW Insurance is 100% independent of any insurance company providing non-biased guidance.

|

One of the top concerns of many retirees is the cost of healthcare as they get older. I offer a complete and comprehensive knowledge of Medicare planning.

We will discuss what is important to you and how you would like your plan to work WHEN you need it. |

|

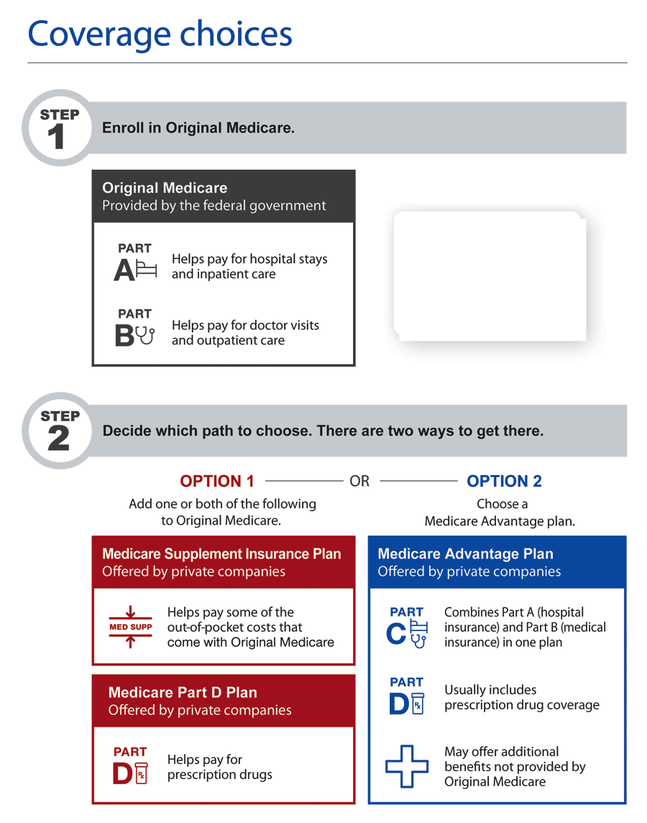

The Different Parts of Medicare

Original Medicare, managed by the federal government, provides Medicare Part A and Part B coverage.

- MEDICARE PART A (Hospital Insurance)

Helps cover inpatient care in hospitals, skilled nursing facilities, hospice care and some home health care, however only if certain conditions are met. - MEDICARE PART B (Medical Insurance)

Helps cover doctor’s services, outpatient medical services, lab services, X-rays, MRIs, CT scans, EKGs, and some other diagnostic tests, some preventative care services, emergency room services, durable medical equipment, mental health as outpatient, some Rx drugs administered by a doctor. - MEDICARE ADVANTAGE PLANS (Part C)

These options (HMOs and PPOs) are approved by Medicare and run by private insurers. They provide insurance for hospital and medical services and sometimes prescription drug coverage. Out-of-pocket costs and cost sharing differ from Original Medicare and may depend on whether services are received in or out of network. Plan choices are based on networks, counties and zip codes. - MEDICARE PRESCRIPTION DRUG COVERAGE (Part D)

Medicare drug plans are run by insurance companies and other private companies approved by Medicare. These should be chosen based on your specific medications as cost and formularies can vary greatly between companies.

Enrollment windows and timing

Timing matters when you’re joining Medicare. When you turn 65 or otherwise become eligible for Medicare, enrollment windows open, but some of these windows will close quickly. If you wait until later to sign up, you may have fewer choices and you may pay more. Here’s a look at when to enroll.

MEDICARE CHOICES

Deciding on which choices are most appropriate for you can depend on where you live, network providers, and overall plan you are most comfortable with. Together we can discuss the complete information you’ll need to bring peace of mind for your decision making.

Medicare supplement plans (Medigap)

Medicare supplement plans (also called Medigap) are specifically designed to supplement and only work with Original Medicare. Private insurance companies offer Medicare supplement plans. Prices can vary greatly among carriers so knowing how those carriers differ in financial strength, customer service, claims paying history, household discounts, etc, are important to be aware of. This is what we look at together to narrow down stronger and appropriate options for you.

Medicare supplement plans:

Medicare supplement plans:

- Help with managing out-of-pocket costs such as deductibles.

- Do not require referrals or prior authorizations.

- Guarantee ability to renew.

- Provide stability and more predictable costs.

- Allow the freedom to choose any doctor who accepts Medicare.

- Offer national coverage so beneficiaries can use benefits anywhere in the U.S.

- Offer limited foreign travel coverage for emergency services (for most plans).

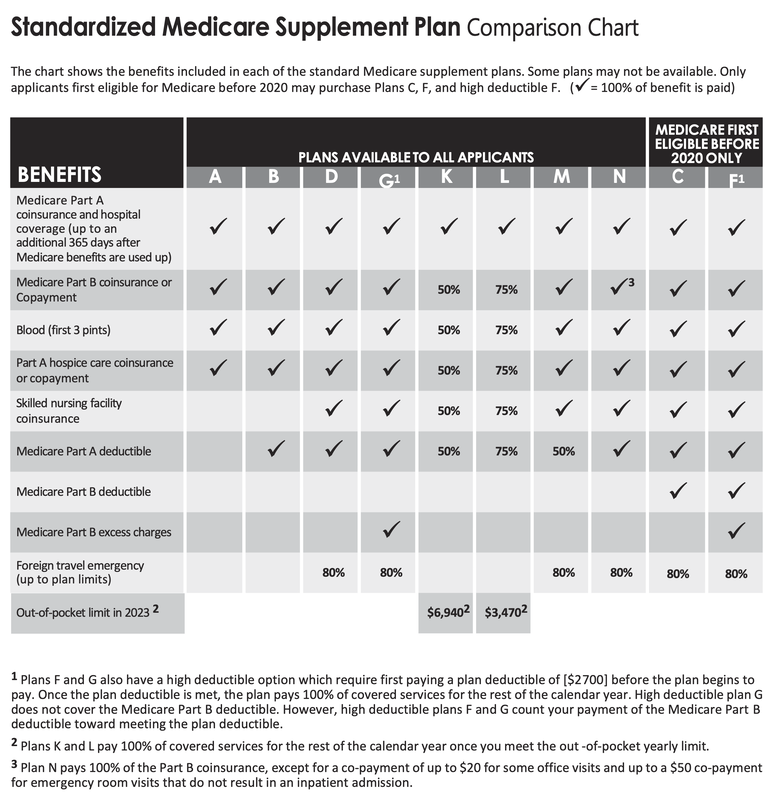

What Medicare supplement plans cover

|

The federal government has 10 different Medicare supplement plans, named with letters from “A” to “N.” (These letters have no relationship to the Medicare Part A, B, C and D designations.) The different types vary in which gaps in coverage they fill.

|

To keep it simple, all policies with the same letter offer the same benefits. This chart shows standard benefits for each plan type. Not all plans are available in all states.

|

Medicare Advantage Plans (Part C)

These plans are offered by private insurance companies and must cover everything included in Original Medicare, all the benefits of Part A and Part B.

- Are offered to those enrolled in Part A & B. You must continue to pay Part B premium.

- Offer HMO’s and PPO’s in which you need to use network providers.

- Choices can vary depending on where you live.

- Typically cover prescription drugs.

- Charge copays for services such as doctor visits, hospitalizations, outpatient care, MRI’s, etc.

- May offer additional benefits such as some dental, vision, or hearing, and wellness programs depending on the plan.

Part D Rx Prescription Drug Plans

- Are optional, but highly recommended due to penalties that could occur.

- Are offered through Medicare Advantage plans or with a standalone drug plan.

- Vary in cost sharing such as premiums, deductibles, copays, tiers, formularies and pharmacies used.

- Allow you to change plans once a year so you are never stuck in a plan.

- Are best discussed with an experienced agent/broker who has your best interest in mind with your specific prescriptions prescribed.

|

|

Which Path will you choose?

Let’s discuss your options in exploring and covering your Medicare health care to preserve your Social Security income and retirement income. Everyone’s situation can be different so it is very helpful to speak with a Medicare specialist.

These are important decisions we can address together to give you peace of mind in your future medical needs. |

SKW Insurance is a woman-owned small business. Kay Winkler is an independent insurance broker based in the Raleigh, Durham, Chapel Hill area of North Carolina, while also currently licensed in NC, SC, and V